Basic HTML Version

10

|

HBA HOME BUILDING NEWS

|

PROtECtING YOUR INDUStRY

|

MARCH, 2013

|

HBApdx.org

The 2013 Legislature is now in

session

. All of our legislative re-

ports will be posted to our blog on

www.oregonhba.com

. Contact our

office for the password to the pro-

tected legislative blog posts and

to subscribe to an RSS feed (this

allows you to be notified when a

new post is made). We will also be

using the blog to discuss session

activity and issues as they arise,

in addition to the weekly reports.

You can also keep up with the

fun in Salem by following me on

Twitter:

twitter.com/jon_ohba or @

jon_ohba.

Below is the report that I pre-

sented to NAHB at the recent

IBS meetings, January 22, 2013

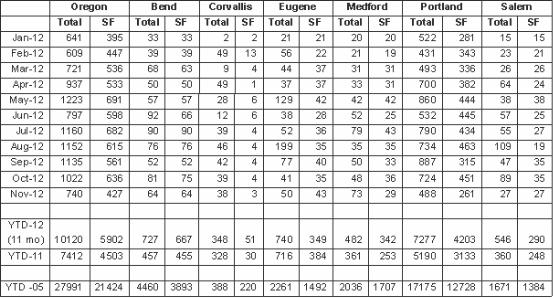

As the chart below indicates,

Oregon’s housing starts continue

to show improvement although

at levels far below what we were

doing at the peak. All of Oregon’s

MSAs are recording more housing

starts through 11 months of 2012

than they did in the entire year of

2011, which is very good news.

Here’s how the Oregon State

Economist’s office described the

state of our industry to the Gov-

ernor and legislature in a recent

report:

While trends in housing are cer-

tainly positive and construction ac-

tivity has generally been increasing

for nearly three years at this point,

it is important to step back and ex-

amine the larger picture….U.S. total

starts have increased about 80%

from the bottom and single family

are up 70 percent. InOregon, the cor-

responding figures are a similar 80%

gain in total starts and a 65 percent

increase in single family, indicating

that Oregon’s multifamily starts are

increasing slightly faster than the

national average.

Today, new residential construc-

tion in Oregon is improving along

with the economy overall. There is

considerable room for improvement

before the level of activity approach-

es anything considered normal. Sin-

gle family new construction in par-

ticular is currently about 45 percent

of its long term average, while mul-

tifamily is doing better and is about

75 percent of its long term average.

In graphic form, see what the

last few years has looked like in

Oregon

(See chart A)

In other news:

• Oregon’s legislature has con-

vened, with the Ds in charge of

both chambers, the Governor’s

office, the Secretary of State’s of-

fice, the State Treasurer, the AG…

in short, pretty much everything

there is to be in charge of. Given

that their top issue on the agenda

legislatively is the state budget

shortfall and what to do about

public employee pensions in par-

ticular, and further given that the

Ds are, shall we say, close to the

public employee unions, it prom-

ises to be a fun session to watch.

•

OHBA completed a thorough

revision of our internal governance

structure, shrinking the size of our

board, eliminating a number of

committees, creating a statewide

Leadership Council, starting an an-

nual conference and a number of

other positive changes. We think

that this will lead to a more active

involvement from our members

and a more nimble decision mak-

ing process.

•

OHBA’s membership contin-

ues to improve ever so slightly, but

that beats dropping like a brick.

•

And a pretty cool item: our

2013 President, David DeHarpport

was sworn in by his father, Dale

DeHarpport, who was our Presi-

dent in 1978 – the first time in our

history that we’ve had a second

generation leader come through

our chairs.

In January HBA staff and mem-

bers attending the International

Builders Show in Las Vegas. HBA

CEO, Dave Nielsen provided these

key take-aways on industry con-

cerns following the conference.

NatIONaL HOUSING

GROWtH / PROjECtIONS

• Housing production (single-

family and multi-family) was up

over 27 percent in 2012 vs 2011,

beating NAHB’s 2012 projections

by about 10 percent.

• Housing prices had first overall

annual growth since 2006, rising

almost 6 percent in 2012.

• Household formations are on the

rise. A normal year is 1.2 million.

We were at a low of 500,000 per

year during the recession years.

We hit 850,000 in 2012.

• Remodeling never dropped as

far as new home construction

and has seen slow but steady

growth the last couple of years.

NAHB projects approximately 2

percent growth in both ’13 and

‘14.

• Multi-Family starts (mostly apart-

ments) have seen significant

growth the past two years (58

percent in ’11 and 38 percent in

’12). NAHB projects slowing but

still strong growth in ‘13 of 22

percent, followed by very mod-

erate growth in ’14 of 6 percent.

• Single-family starts fell the most

and so have the farthest to climb

out. After bottoming out in ’11,

there was a 23 percent increase

in ’12. NAHB projects a 23 per-

cent increase in ’13 and a 30 per-

cent increase in ’14. Even though

this means a doubling of homes

built in three years, levels will still

be at only 70 percent of normal

amounts (calculated as the early

2000’s before the boom hit).

BUILDING MatERIaLS/

PRICING

• Chinese Drywall: For health is-

sues, the product has either been

banned or they must retool their

plants to meet the new sulfur

limit requirement. NAHB’s ef-

fort kept the sulfur content issue

from spreading into other build-

ing products which could have

had a significant impact on con-

struction costs.

• Overall modest price increases

in building materials expected in

2013 with the exceptions of soft

lumber materials and gypsum

where more significant increases

(13 percent) will be experienced.

• Looming OSB price increases due

to limited demand in previous 5

years and slowness in rebuild-

ing production. Also impacted

by the “Sandy effect.” Builders

reporting increases in various re-

gions from 7 percent-30 percent.

• Concrete production is at 68 per-

cent utilization looking to hit 73

percent in 2013. As this number

grown up to 90 percent we will

continue relying on foreign de-

livery to manage peaks until we

top 90 percent overall utilization

so that the previously closed

plant can reopen.

• With the depressed pricing over

the past 5 years, buyers are go-

ing to experience sticker shock as

new houses are built on more ex-

pensive lots and with increased

material costs. Some areas are

seeing in excess of 10 percent

increases.

GREEN BUILDING

• Green Building Buyer Preferenc-

es (according to a recent NAHB

survey)

• 100 percent of prospective

homebuyers say they are inter-

ested in seeing EE features in

new construction, but only 14

percent are willing to pay more

for those features. The 14 per-

cent that do say they paid more

for certain EE features pay an

average of only $7,000 more for

that home.

• 71 percent of buyers prefer buy-

ing a home from a builder with

an energy certification or adver-

tise themselves as having green

building construction knowl-

edge.

• Federal tax credits for green re-

modeling and green home build-

ing: All were extended into 2013.

HBA and OHBA are working to

provide a summary of these

credits and how to utilize them

within the next couple of weeks.

CODES

• International Codes Update:

NAHB scored a successful out-

come on 273 of 336 code change

proposals on which they took a

stand. For more info, including

a summary of the more signifi-

cant changes, go to nahb.org/

GroupA.

• ICC working with AIA and NAHB

to look at 3-year code cycle and

reconsidering a 6 year cycle.

• ICC will now allow electronic vot-

ing, which means significantly

more codes officials from around

the Country will be determin-

ing future code changes. Local

HBAs will need to be even more

involved with local officials on

areas of concern to our industry.

aIR tIGHtNESS/MOIStURE

CONtROL

• Research Center has been moni-

toring 22 homes for air tightness

andmoisture control. The homes

were built to the requirements of

the 2012 IECC in a variety of cli-

mate zones (3 of the homes are

in Portland).

• Type in “Air Tightness” into the

search bar on the NAHB website

to get the data from the working

group.

OtHER NatIONaL NEWS

• NAHB International Builders

Show (IBS) will be held in same

location and dates as the Na-

tional Kitchen and Bath Industry

Show in 2014

• NAHB saved builders $7,250 per

home through lobbying efforts

in 2012 alone.

• Nationally, all signs of a turning

economy are evident with only

1 or 2 state exceptions. After 4

years of decline, 2012 showed

positive housing growth.

News from the Oregon Home

Builders Association

Jon Chandler’s

Oregon

Update

cHART A

Summary report: NAHB / IBS conference

sions that are made consider the

homebuilder’s concerns and our

perspective on the market.

Over the course of the next six

months, the group will be review-

ing assumptions used for the cal-

culation of available residential

infill lands to help Metro better

calculate what’s likely to rede-

velop and at what densities. We’ll

also be reviewing definitions for

residential single family and mul-

tifamily categorizations to ensure

that Metro’s growth assumptions

match the market’s definitions for

residential housing. These critical

definitions and calculations may

seem like small details but deci-

sions at these initial levels can dra-

matically influence regional deci-

sion making, and may ultimately

make the difference between a

well supported UGB decision or

one which falls victim to another

seemingly endless cycle of slow

decision making and legal entan-

glement.

Inside Line:

HBA

and the UGB

Continued from page 9